Business Valuations Sydney :: Business Valuations By Certified Business Valuers

Business Valuations Sydney – Melbourne – Brisbane – Canberra – Adelaide – Perth – Newcastle

: Services provided by Xcllusive Business Agency

Business Valuations

Sydney – Melbourne – Brisbane – Canberra – Adelaide – Perth – Newcastle

: Services provided by Xcllusive Business Agency

call

Unlocking the Secrets of Business Valuation: A Step-by-Step Guide to Value My Business

VALUATION

WHAT OTHERS ARE SAYING ABOUT US…

***The most honest and intuitive organisation***

“I can honestly say, as a person who has now sold three businesses in the past 8 years, Xcllusive is far and away the most honest and intuitive organisation that I have had the pleasure of dealing with.”

Leon J. – Import and Wholesaling business

“No member of a crew is praised for the rugged individuality of his rowing.”

–Ralph Waldo Emerson

Demystifying Business Valuation

For many entrepreneurs and business owners, the idea of valuing their business can seem like an intimidating task. However, understanding how to value your business is a fundamental skill that can empower you to make informed decisions, whether you’re considering selling your company, seeking investors, or simply assessing your business’s financial health. In this two-part guide, we will demystify the process of business valuation, step by step, so that anyone can understand and apply it to their own enterprise.

What is Business Valuation?

At its core, business valuation is the process of determining the financial value of your business. It’s similar to finding out the market price of a car or a house, but in this case, the asset in question is your business. The goal of business valuation is to estimate the fair and defensible value of your company based on various factors, data, and established methodologies.

Why Business Valuation Matters

Understanding why business valuation is important can help you appreciate its significance. Here are some key reasons why business valuation matters:

- Selling Your Business: If you’re considering selling your business, knowing its value is essential. It helps you set a realistic asking price, attracts potential buyers, and aids in negotiations for a fair deal.

- Seeking Investment: When looking to attract investors or secure loans, providing a business valuation is crucial. It demonstrates your company’s potential and attractiveness to potential financial backers.

- Mergers and Acquisitions: In cases where your business might merge with another or be acquired, knowing the accurate value of your company is vital for making informed decisions and negotiating favorable terms.

- Financial Planning: Business valuations are essential for financial planning and can help you assess your company’s financial health, make strategic decisions, and plan for future growth.

- Estate Planning: If you’re considering transferring business ownership to family members or beneficiaries, business valuations ensure an equitable distribution of assets.

- Financial Reporting: Publicly traded companies must regularly report their financials, including the value of their assets and liabilities, based on proper valuations.

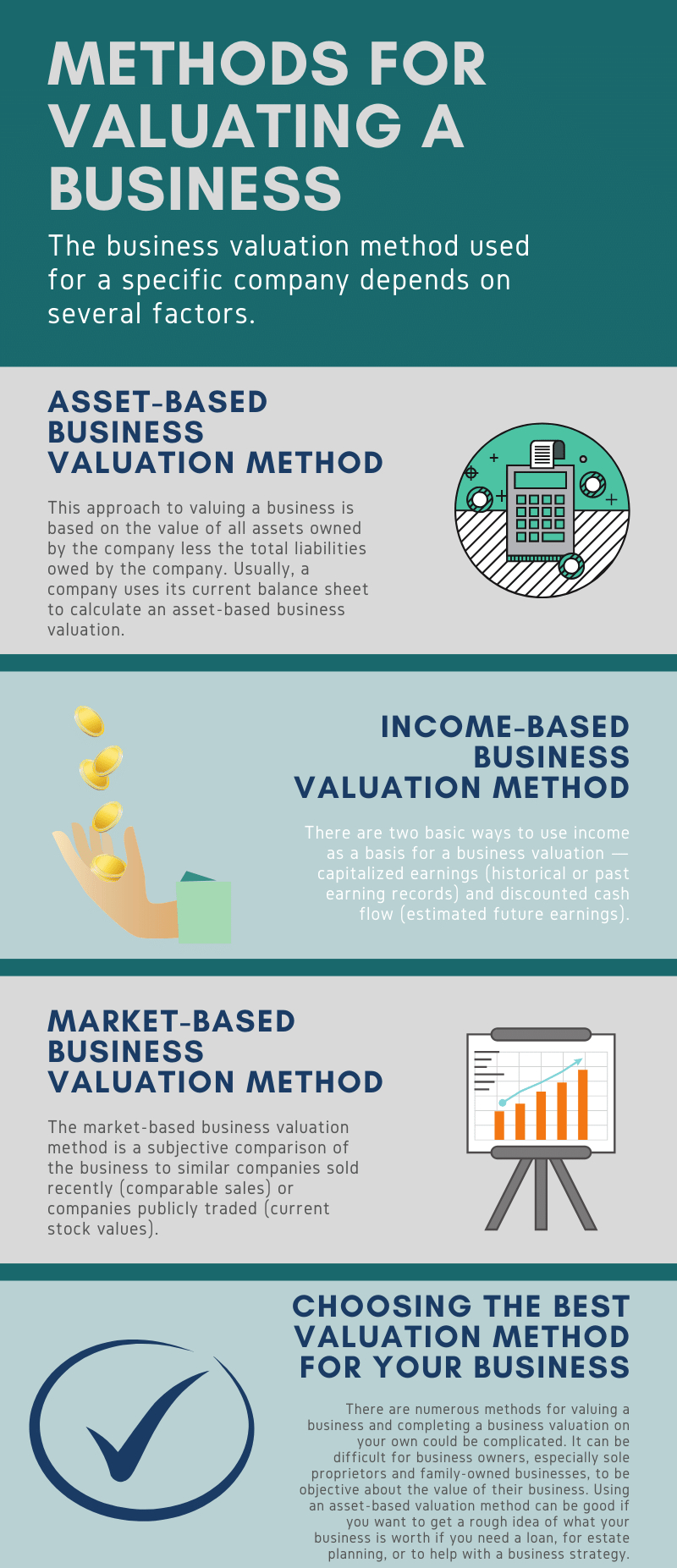

The Methods of Business Valuation

Business valuation is not a one-size-fits-all process; it involves various methods and approaches tailored to the unique characteristics of your business. Here are the primary methods of business valuation:

- Asset-Based Approach: This method determines the value of your business by assessing its assets (both tangible and intangible) and subtracting its liabilities.

- Tangible Assets: These include real estate, equipment, inventory, and other physical assets.

- Intangible Assets: Intangible assets such as patents, trademarks, copyrights, and brand reputation significantly contribute to value.

This method is commonly used for asset-heavy businesses such as manufacturing companies or those preparing for liquidation.

- Income-Based Approach: The income-based approach focuses on estimating the future cash flows your business is expected to generate. It is especially useful for businesses with consistent revenue streams or strong growth potential.

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to their present value using a discount rate that reflects risk and the time value of money.

- Capitalization of Earnings: This simpler method divides annual earnings by a capitalization rate to estimate value.

This approach is widely used for startups and businesses in industries with predictable income patterns.

- Market-Based Approach: In this approach, your business’s value is determined by comparing it to similar companies in the market that have been sold recently.

- Comparable Company Analysis (CCA): This method uses financial metrics like Price-to-Earnings (P/E) ratios or EV/EBITDA multiples from comparable businesses.

- Market Multiples: These are benchmarks derived from the sale prices of similar companies within the same industry.

This approach relies on market data and trends to arrive at a valuation. It is particularly useful for small businesses and startups.

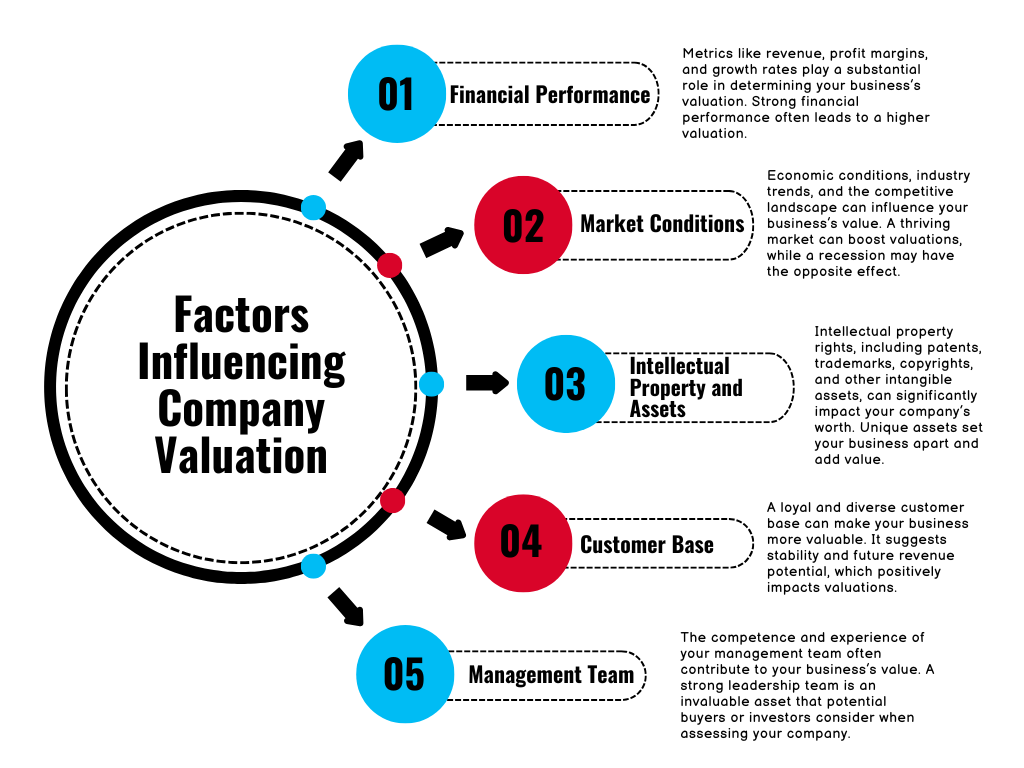

Factors Influencing Business Valuation

Several factors can significantly impact the valuation of your business. Understanding these factors can help you appreciate why two seemingly similar businesses may have different valuations:

- Financial Performance: Metrics like revenue, profit margins, and growth rates play a substantial role in determining your business’s valuation. Strong financial performance often leads to a higher valuation.

- Market Conditions: Economic conditions, industry trends, and the competitive landscape can influence your business’s value. A thriving market can boost valuations, while a recession may have the opposite effect.

- Intellectual Property and Assets: Intellectual property rights, including patents, trademarks, copyrights, and other intangible assets, can significantly impact your company’s worth. Unique assets set your business apart and add value.

- Customer Base: A loyal and diverse customer base can make your business more valuable. It suggests stability and future revenue potential, which positively impacts valuations.

- Management Team: The competence and experience of your management team often contribute to your business’s value. A strong leadership team is an invaluable asset that potential buyers or investors consider when assessing your company.

Steps to Value Your Business

Now that you have a grasp of the key concepts in business valuation, let’s explore the steps you can follow to conduct a business valuation effectively:

Step 1: Gather Financial Statements

Begin the valuation process by collecting your business’s financial statements. These statements should include income statements, balance sheets, and cash flow statements for the past few years. These documents offer valuable insights into your business’s historical financial performance.

Step 2: Identify Assets and Liabilities

List all the assets your business possesses, both tangible and intangible. Tangible assets may include real estate, equipment, and inventory. Intangible assets encompass intellectual property, such as patents, trademarks, and copyrights. Next, list your liabilities, including loans, debts, and outstanding bills.

Step 3: Analyze Earnings

Utilize the income-based approach to assess your earnings. Estimate your future cash flows by considering factors like revenue growth, operating expenses, and any one-time income or expenses. The Discounted Cash Flow (DCF) analysis is a commonly used method under this approach, which calculates the present value of projected future cash flows. It considers factors like revenue growth, operating expenses, and anticipated income.

Step 4: Consider Market Data

If applicable, investigate recent sales of similar businesses in your industry and region. This can provide a benchmark for your business’s value. The market-based approach relies on such data to arrive at a valuation that aligns with market trends.

Step 5: Choose the Right Valuation Method

Select the most appropriate valuation method or a combination of methods based on your business’s nature and the data available. Small businesses and startups often lean towards the market-based approach, while businesses with significant tangible assets may favor the asset-based approach.

Step 6: Adjust for Specific Factors

Take into account any unique factors that may affect your business’s value. Market trends, industry-specific conditions, and the competitive landscape are examples of factors that may necessitate adjustments to your valuation.

Step 7: Consult a Professional

If you are uncertain about the valuation process or want an expert opinion, consider working with a business valuation expert or consultant. These professionals can provide invaluable insights, ensure accuracy, and help you navigate complexities.

Step 8: Document Your Valuation

Once you’ve completed the valuation, document your findings in a clear and organized manner. Proper documentation is essential, especially if you plan to present the valuation to potential buyers, investors, or lenders.

Step 9: Review and Update Regularly

Remember that valuations are not static. They can change over time due to various factors, including shifts in the market and your business’s financial performance. Periodically review and update your business valuation to ensure it remains relevant and accurate.

Why Understanding Valuations Matters

For everyday people, understanding business valuations offers several benefits:

- Informed Investing: Valuations help you identify undervalued or overvalued stocks, making your investments smarter.

- Entrepreneurial Insights: Knowing how valuations work can help you build and sell a business strategically.

- Economic Awareness: Understanding valuations deepens your grasp of financial news and trends.

Emerging Trends in Valuation

The concept of valuation is evolving to include new metrics and considerations, such as:

- Sustainability and ESG (Environmental, Social, and Governance): Companies that prioritize sustainable practices are often valued higher as investors place importance on ethical operations.

- Digital Transformation: Companies leveraging technology and digital tools are often more competitive, boosting their valuation.

- Globalization: Access to international markets can significantly impact a company’s worth, especially for businesses in industries like tech and e-commerce.

Common Pitfalls in Business Valuations

Business valuation can be prone to errors. Avoid these common mistakes:

- Over-Optimistic Forecasts: Inflated revenue projections can lead to unrealistic valuations.

- Ignoring Market Trends: Failing to account for industry dynamics can result in undervaluation or overvaluation.

- Incomplete Financial Records: Disorganized or missing data compromises accuracy.

- Neglecting Intangible Assets: Ignoring intellectual property or brand value can significantly lower valuation.

Conclusion

By following these steps and considering the different valuation approaches, you can confidently answer the question, “How do I value my business?” Armed with this knowledge, you’ll be better equipped to make informed decisions, whether you’re selling your business, attracting investors, or simply assessing your company’s financial health.

In conclusion, business valuation is not just for the financial elite; it is a valuable tool that can empower business owners and entrepreneurs to make strategic decisions and understand the worth of their ventures. We hope this comprehensive guide has demystified the concept and provided you with the clarity and confidence to navigate the world of business valuation effectively.

350+

Businesses Sold

1,250+

Appraisals

10,985

Motivated Buyers

Enquire Now About An Expert Business Valuations – Contact Us or Call Us Today on:

1800 825 831

or…

Fill In The Form Below and One Of Our

Experienced Team Members Will Contact You:

A business valuation is not the amount that the business can definitely be sold for. A valuation is simply the opinion of an expert who understands the field in which the assets are being valued and has acquired, through proper investigation, all necessary data and facts about the business being valued.

Following this, the expert will then evaluate this data and run a comparison with internal and external forces affecting the enterprise. This, together with market data, historical sales and other possible investments compared to this business, the valuer can then establish their opnion of the business value.

The emphasis here is on expert opinion and possible business value. The only way to determine the exact value of the business is to arrange an arms length transaction of that business.

The international value standards (IVS) refer to market value as follows-

“Market value is the estimate and amount for which an asset is to exchange on the date of valuation between a willing buyer, and willing seller, in an arms length transaction wherein each of the parties has acted knowledgeably prudently and without compulsion.”

Most Valuations are not commissioned for the purpose of selling the business on the open market as an arms length transaction. It is far more common for valuations to be commissioned for the purposes of determining the value of the business that will not go on the open market. These instances may include-

- Partnership Dissolution

- Family Matters

- Divorce settlements

- Raising the Capital Finance

- Determining a by-in price

- Estate planning

Baring all of these facts in mind, it is very important, when doing the Valuation, to find the right expert who will produce a logical and factual Valuation backed by evidence that will help you through your decision process or resolution quickly and efficiently. So to find out more call us any time including after hours and weekends or fill in the form below.

1800 825 831

or…

Fill In The Form Below and One Of Our

Experienced Team Members Will Contact You:

WHAT OTHERS ARE SAYING ABOUT US…

***The most honest and intuitive organisation***

“I can honestly say, as a person who has now sold three businesses in the past 8 years, Xcllusive is far and away the most honest and intuitive organisation that I have had the pleasure of dealing with.”

Leon J. – Import and Wholesaling business

VALUATION