Business Valuations Sydney :: Business Valuations By Certified Business Valuers

Business Valuations Sydney – Melbourne – Brisbane – Canberra – Adelaide – Perth – Newcastle

: Services provided by Xcllusive Business Agency

Business Valuations

Sydney – Melbourne – Brisbane – Canberra – Adelaide – Perth – Newcastle

: Services provided by Xcllusive Business Agency

call

Demystifying Company Valuations: A Comprehensive Guide for Everyday People

VALUATION

WHAT OTHERS ARE SAYING ABOUT US…

***The most honest and intuitive organisation***

“I can honestly say, as a person who has now sold three businesses in the past 8 years, Xcllusive is far and away the most honest and intuitive organisation that I have had the pleasure of dealing with.”

Leon J. – Import and Wholesaling business

“No member of a crew is praised for the rugged individuality of his rowing.”

–Ralph Waldo Emerson

Unraveling the Basics of Company Valuations

Understanding the intricacies of company valuations is crucial for business owners, investors, and anyone looking to delve into the world of corporate finance. In this two-part guide, we will break down the concept of company valuations into easily digestible pieces, making it accessible to everyday people. By the end of this article, you’ll have a firm grasp of what company valuations entail and why they matter.

What is Company Valuation?

Company valuation is the process of assigning a financial value to a business entity. Think of it as determining the price tag for a car, house, or any other significant asset, but in this case, the asset is a company. The primary objective of company valuation is to estimate the fair and justifiable value of a business based on various factors, data, and methodologies.

Why Company Valuations Matter

Understanding why company valuations are important is the first step in appreciating their significance. Company valuations serve several essential purposes:

- Selling a Business: If you’re a business owner looking to sell your company, knowing its value is crucial. It helps you set a realistic asking price, attract potential buyers, and engage in meaningful negotiations to secure a fair deal.

- Seeking Investment: Entrepreneurs seeking investors or loans often need to provide a company valuation. This valuation demonstrates the potential and attractiveness of the business to potential financial backers.

- Mergers and Acquisitions: In the context of mergers or acquisitions, understanding the accurate value of the target company is vital. It guides decision-making and negotiation processes.

- Financial Health Assessment: Company valuations play a critical role in assessing a business’s financial health. They help business owners make strategic decisions and plan for future growth.

- Financial Reporting: Publicly traded companies are required to regularly report their financials, including the value of their assets and liabilities, based on proper valuations.

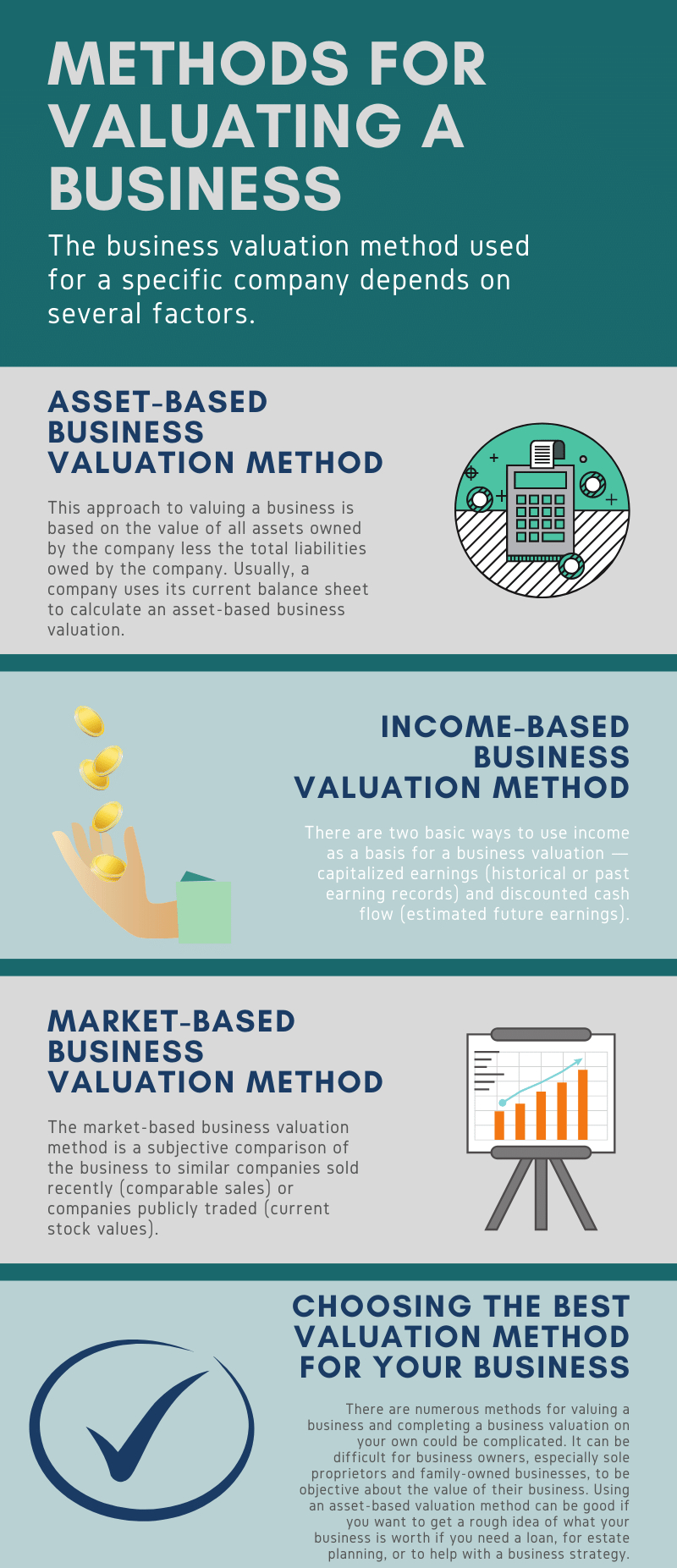

The Methods of Company Valuation

Company valuation is not a one-size-fits-all process. It involves various methods and approaches tailored to the unique characteristics of the business. Here are the primary methods of company valuation:

- Asset-Based Approach: This method values a company by assessing its assets (both tangible and intangible) and subtracting its liabilities.

- Net Asset Value (NAV): Subtract liabilities from total assets to get the NAV.

- Tangible vs. Intangible Assets: Tangible assets include physical items like real estate, equipment, and inventory, while intangible assets encompass intellectual property like patents, trademarks, and copyrights. This approach is often used for companies with substantial physical assets.

- Income-Based Approach: In this approach, the focus shifts to estimating the future cash flows the company is expected to generate.

- Discounted Cash Flow (DCF) Analysis: Projects future cash flows and discounts them to their present value using a discount rate (reflecting risk and time value of money).

- Capitalization of Earnings: Divides the expected annual earnings by a capitalization rate (a measure of risk and return).

This method requires accurate forecasts and is highly sensitive to assumptions.

- Market-Based Approach: The market-based approach determines a company’s value by comparing it to similar companies in the market that have recently been sold. This approach relies on market data and trends to arrive at a valuation. It is particularly useful for smaller businesses and startups.

- Comparable Company Analysis (CCA): Compares the target company with similar ones recently sold.

- Multiples Approach: Uses financial metrics like Price-to-Earnings (P/E) or Enterprise Value-to-EBITDA (EV/EBITDA) ratios.

- Liquidation Value

For businesses in distress, the liquidation value approach estimates the value of a company’s assets if sold off quickly. While this method yields conservative valuations, it’s crucial in bankruptcy or closure scenarios.

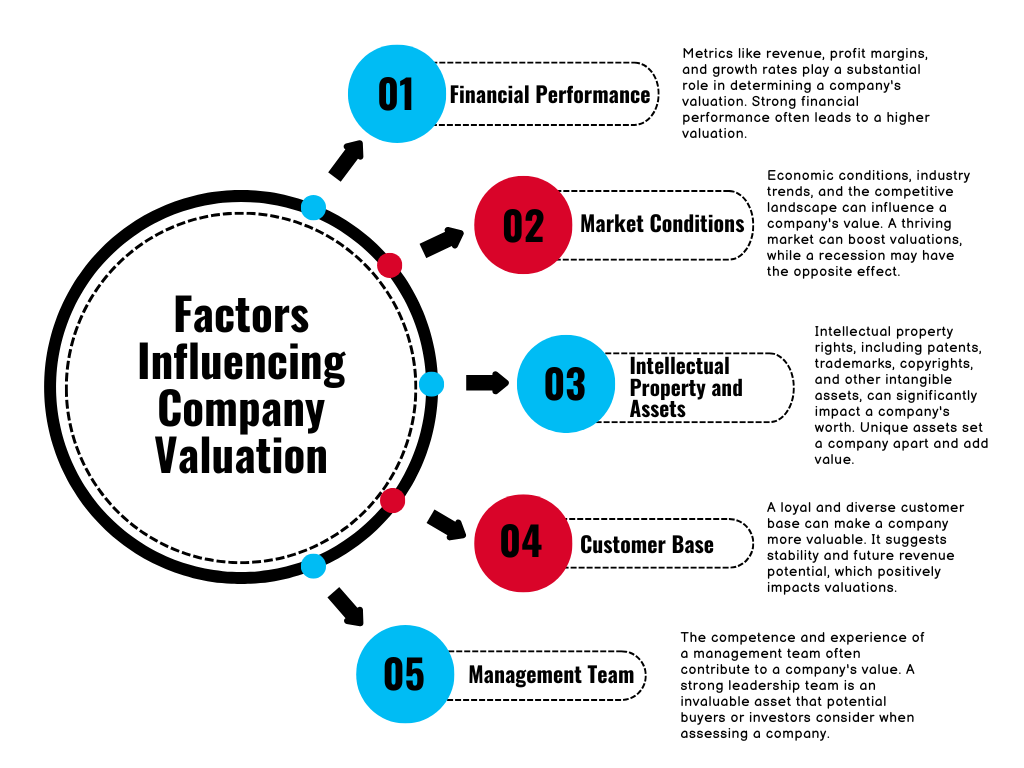

Factors Influencing Company Valuation

Several factors can significantly impact the valuation of a company. Understanding these factors can help you appreciate why two seemingly similar companies may have different valuations:

- Financial Performance: Metrics like revenue, profit margins, and growth rates play a substantial role in determining a company’s valuation. Strong financial performance often leads to a higher valuation.

- Market Conditions: Economic conditions, industry trends, and the competitive landscape can influence a company’s value. A thriving market can boost valuations, while a recession may have the opposite effect.

- Intellectual Property and Assets: Intellectual property rights, including patents, trademarks, copyrights, and other intangible assets, can significantly impact a company’s worth. Unique assets set a company apart and add value.

- Customer Base: A loyal and diverse customer base can make a company more valuable. It suggests stability and future revenue potential, which positively impacts valuations.

- Management Team: The competence and experience of a management team often contribute to a company’s value. A strong leadership team is an invaluable asset that potential buyers or investors consider when assessing a company.

Steps to Value a Company

Now that you have a grasp of the key concepts in company valuations, let’s explore the steps you can follow to conduct a company valuation effectively:

Step 1: Gather Financial Statements

Begin the valuation process by collecting the company’s financial statements. These statements should include income statements, balance sheets, and cash flow statements for the past few years. These documents offer valuable insights into the company’s historical financial performance.

Step 2: Identify Assets and Liabilities

List all the assets the company possesses, both tangible and intangible. Tangible assets may include real estate, equipment, and inventory, while intangible assets encompass intellectual property like patents, trademarks, and copyrights. Next, list the company’s liabilities, including loans, debts, and outstanding bills.

Step 3: Analyze Earnings

Utilize the income-based approach to assess the company’s earnings. Estimate the future cash flows the company is expected to generate by considering factors like revenue growth, operating expenses, and any one-time income or expenses. The Discounted Cash Flow (DCF) analysis is a commonly used method under this approach, calculating the present value of projected future cash flows.

Step 4: Consider Market Data

If applicable, investigate recent sales of similar companies in the industry and region. This can provide a benchmark for the company’s value. The market-based approach relies on such data to arrive at a valuation that aligns with market trends.

Step 5: Choose the Right Valuation Method

Select the most appropriate valuation method or a combination of methods based on the company’s nature and the data available. Smaller businesses and startups often lean towards the market-based approach, while companies with substantial tangible assets may favor the asset-based approach.

Step 6: Adjust for Specific Factors

Take into account any unique factors that may affect the company’s value. Market trends, industry-specific conditions, and the competitive landscape are examples of factors that may necessitate adjustments to the valuation.

Step 7: Consult a Professional

If you are uncertain about the valuation process or want an expert opinion, consider working with a company valuation expert or consultant. These professionals can provide invaluable insights, ensure accuracy, and help you navigate complexities.

Step 8: Document Your Valuation

Once you’ve completed the valuation, document your findings in a clear and organized manner. Proper documentation is essential, especially if you plan to present the valuation to potential buyers, investors, or lenders.

Step 9: Review and Update Regularly

Remember that valuations are not static. They can change over time due to various factors, including shifts in the market and the company’s financial performance. Periodically review and update the company’s valuation to ensure it remains relevant and accurate.

Why Understanding Valuations Matters

For everyday people, understanding company valuations offers several benefits:

- Informed Investing: Valuations help you identify undervalued or overvalued stocks, making your investments smarter.

- Entrepreneurial Insights: Knowing how valuations work can help you build and sell a business strategically.

- Economic Awareness: Understanding valuations deepens your grasp of financial news and trends.

Emerging Trends in Valuation

The concept of valuation is evolving to include new metrics and considerations, such as:

- Sustainability and ESG (Environmental, Social, and Governance): Companies that prioritize sustainable practices are often valued higher as investors place importance on ethical operations.

- Digital Transformation: Companies leveraging technology and digital tools are often more competitive, boosting their valuation.

- Globalization: Access to international markets can significantly impact a company’s worth, especially for businesses in industries like tech and e-commerce.

Common Pitfalls in Company Valuations

1. Over-Optimism

Overestimating growth potential or underestimating risks can inflate valuations.

2. Ignoring Market Trends

Failing to account for broader industry or economic changes can skew results.

3. Incomplete Data

Using outdated or incomplete financial information can lead to inaccuracies.

4. Emotional Bias

Personal attachment to a business (especially for founders) can result in unrealistic valuations.

Conclusion

By following these steps and considering the different valuation approaches, you can confidently navigate the process of valuing a company. Whether you are a business owner, investor, or simply interested in understanding the financial dynamics of the corporate world, a solid understanding of company valuations empowers you to make informed decisions and assess the worth of a business.

In conclusion, company valuations are a critical aspect of corporate finance, impacting various aspects of business transactions and financial planning. We hope this comprehensive guide has provided you with the knowledge and clarity to approach company valuations with confidence and make well-informed decisions in the world of business.

350+

Businesses Sold

1,250+

Appraisals

10,985

Motivated Buyers

Enquire Now About An Expert Company Valuations – Contact Us or Call Us Today on:

or…

Fill In The Form Below and One Of Our

Experienced Team Members Will Contact You:

A business valuation is not the amount that the business can definitely be sold for. A valuation is simply the opinion of an expert who understands the field in which the assets are being valued and has acquired, through proper investigation, all necessary data and facts about the business being valued.

Following this, the expert will then evaluate this data and run a comparison with internal and external forces affecting the enterprise. This, together with market data, historical sales and other possible investments compared to this business, the valuer can then establish their opnion of the business value.

The emphasis here is on expert opinion and possible business value. The only way to determine the exact value of the business is to arrange an arms length transaction of that business.

The international value standards (IVS) refer to market value as follows-

“Market value is the estimate and amount for which an asset is to exchange on the date of valuation between a willing buyer, and willing seller, in an arms length transaction wherein each of the parties has acted knowledgeably prudently and without compulsion.”

Most Valuations are not commissioned for the purpose of selling the business on the open market as an arms length transaction. It is far more common for valuations to be commissioned for the purposes of determining the value of the business that will not go on the open market. These instances may include-

- Partnership Dissolution

- Family Matters

- Divorce settlements

- Raising the Capital Finance

- Determining a by-in price

- Estate planning

Baring all of these facts in mind, it is very important, when doing the Valuation, to find the right expert who will produce a logical and factual Valuation backed by evidence that will help you through your decision process or resolution quickly and efficiently. So to find out more call us any time including after hours and weekends or fill in the form below.

1800 825 831

or…

Fill In The Form Below and One Of Our

Experienced Team Members Will Contact You:

WHAT OTHERS ARE SAYING ABOUT US…

***The most honest and intuitive organisation***

“I can honestly say, as a person who has now sold three businesses in the past 8 years, Xcllusive is far and away the most honest and intuitive organisation that I have had the pleasure of dealing with.”

Leon J. – Import and Wholesaling business

VALUATION